The market is heading into a traditional downcycle, as 2023 is seeing significant excess capacity being delivered, and in all likelihood the same will happen in 2024, reports Sea-Intelligence. The question then remains of when the current and overcoming overcapacity market will balance again.

On this matter, CEO Alan Murphy offers little hope of a rapid turnaround.

“Absent an explosion in global container demand, another pandemic soaking up capacity, or carriers laying up a significant share of the global fleet and ordering no more vessels, then we could see a 2019-level of supply/demand balance in 2028,” he cautiously observes.

”Gaining this balance in 2028 would imply an 8-year span – the same as the cycle from the financial crisis until balance was restored again in 2017. The worst of the overcapacity will be seen in 2024, and by 2026, 1/3rd of the overcapacity will have been absorbed.

“However, if the assumptions underpinning the positive scenario are put in jeopardy by lower demand growth, even modest supply growth, or a lower structural factor, all of which are quite likely, then the 2019-level balance could be pushed out to 2030 or beyond.”

In issue 637 of the Sunday Spotlight, Sea-Intelligence defined the most positive scenario, within reason, from the perspective of the carriers, as the following:

- Container volume growth of 3.8% Y/Y from 2024, matching the average growth of the post-financial crisis and pre-pandemic period of 2011-2019.

- Supply growth in 2023-2026 based on the current orderbook.

- Supply growth of just 1.3% for the period post-2026, matching the lowest level seen in the past 10 years (in 2016).

- A “structural factor” – i.e. how much faster supply can grow over demand, with the market remaining in balance – of 2.2 percentage points.

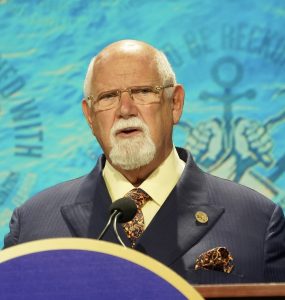

(Photo of Hapag-Lloyd container ship)