By John Corey*

The Shipping Conference Exemption Act, 1987 (SCEA) is a piece of legislation which allows international ocean carriers to be exempt from competition law in Canada. When I first looked into SCEA I was astounded. How could one industry be allowed to form conferences where carriers could join together to fix rates and control service supply?

The Shipping Conference Exemption Act, 1987 (SCEA) is a piece of legislation which allows international ocean carriers to be exempt from competition law in Canada. When I first looked into SCEA I was astounded. How could one industry be allowed to form conferences where carriers could join together to fix rates and control service supply?

No other industry in Canada has such preferential treatment enshrined in legislation. SCEA has been in force for 35 years. Until now SCEA did not have much effect on our daily lives But then Covid-19 happened.

The Covid-19 shutdown started in March 2020 and caused an immediate and severe contraction of everything. That contraction lasted for four to six weeks, with a rebound starting in May 2020. Throughout the summer and fall 2020 there was a major bounce back in demand for goods. During the pandemic, the Canadian supply chain, serviced by trucking and rail, allowed the country to continue to function during the worst pandemic in 100 years.

However, the marine sector by contrast has been plagued with delays, weakened or no service and sky rocketing rates for containers. Initially, ocean carriers were quick to adjust their capacity to match the drop in demand. This resulted in numerous blank sailings.

But demand did not stay down for long. People stuck at home began buying online with a vengeance and have not stopped. As this consumer demand started to rise, carriers started rolling contracts and charging spot prices, even when a shipper had an existing contract. Empty containers were being repositioned back to Asia, rather than making them available to Canadian exporters. This practice has been devastating to Canadian exporters.

Meanwhile carriers have been making record profits. Many pundits think the carrier pricing power and spot pricing may become the new norm.

These service and rate issues are North American wide. In March 2020 the US Federal Maritime Commission (FMC) launched an investigation into the situation, expanding the scope to include among other things, “practices related to the carriage of US exports.” More recently, on March 9, 2021, congressional lawmakers sent a letter to the FMC to voice concern about the current state of the ocean shipping market that has resulted in U.S. exporters having a difficult time obtaining containers.

Canadian shippers have requested that the Canadian Government investigate the container shortage situation and take appropriate action. So far there has been no response.

Carriers must be held accountable to customers

Under section 17 of SCEA, a shipper may bring a complaint to the Canadian Transportation Agency (CTA) if they experience unreasonable service or rates. As noted, SCEA came into force in 1987. Since then, the CTA has never rendered a decision with regard to SCEA. A shipper must make a complete application to the Agency, the carriers then have an opportunity to reply, the pleadings are analysed, and finally the Agency renders a decision. CTA decisions are to be rendered in 90 days. This rarely happens with complex cases. And this is a complex case; no comparative cases for 35 years and international carriers allowed to practise anti-competitive behavior.

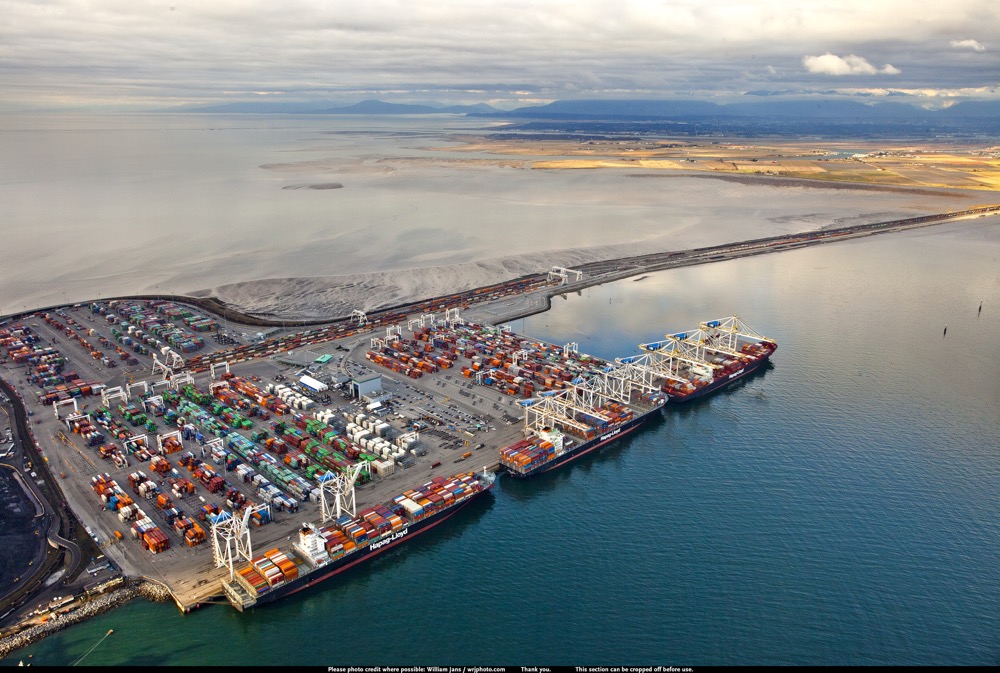

What would a CTA decision look like? If relief was granted to shippers, would it be enforceable? Would a decision for shippers be appealed by the carriers? How does a shipper get some help? First, scrap SCEA and make international ocean carriers subject to Canadian competition law. Next, allow dispute resolution under the Canada Transportation Act, which currently handles dispute resolution for domestic and international air service and rail disputes and finally, hold ocean carriers accountable to their customers. (Photo Vancouver Fraser Port Authority)

*John Corey is President of the Freight Management Association of Canada, whose members purchase approximately $2 billion in transportation services by ship, rail, truck, courier and air freight.